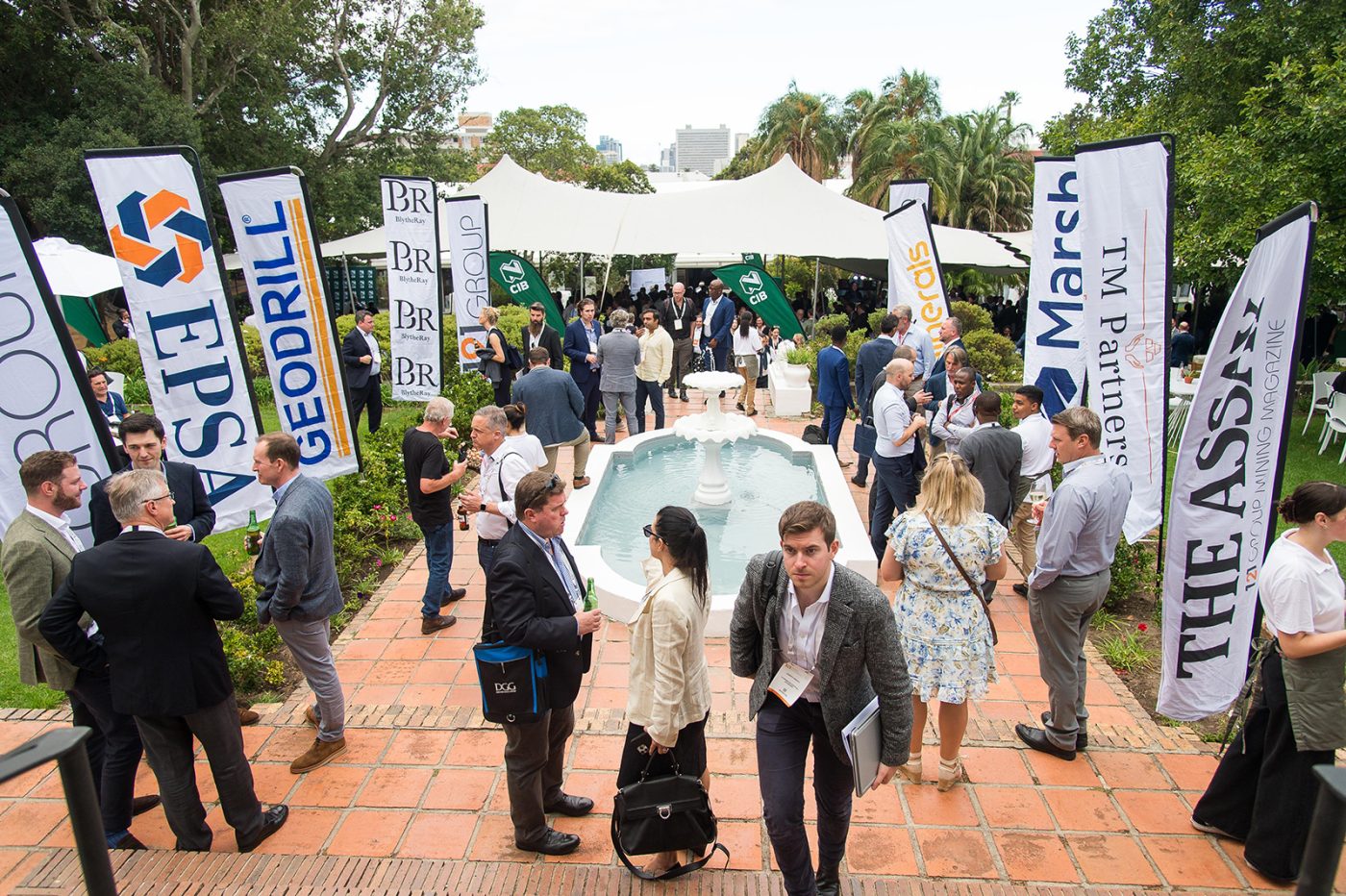

Discover the universe of new mining projects and find those that align with your investment goals.

Connect with the audience you want to meet; only qualified investors and CEOs of mining companies are able to attend.

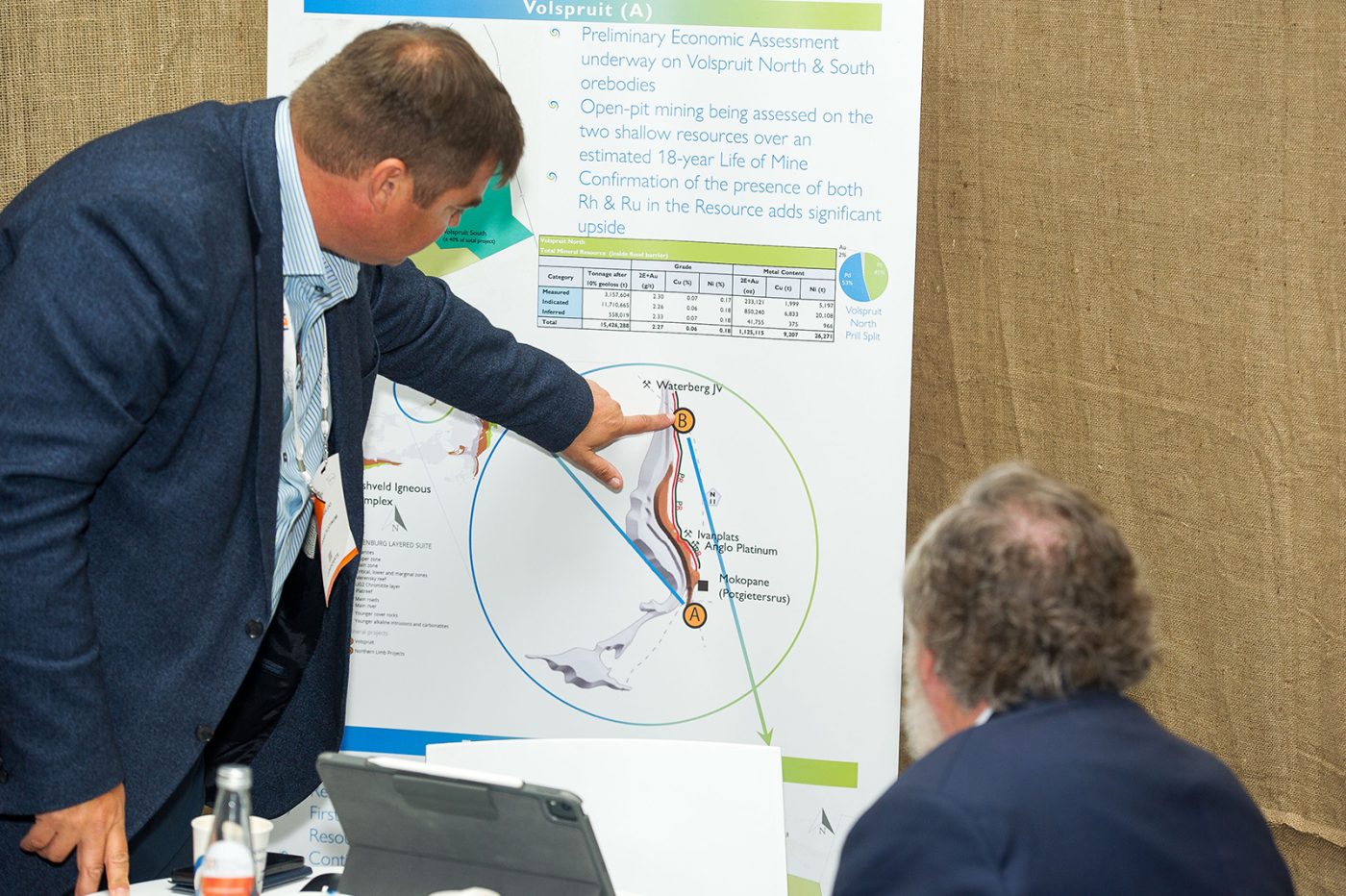

Analyze mining projects and the value opportunities they bring, and make strategic business deals to diversify your portfolio against economic risk.

Learn from informed economic outlooks on the current and future affairs surrounding minerals and the mining sector.